SAN JOSE, Calif., August 9, 2022 — Bloom Energy Corporation (NYSE: BE) today announced financial results for its second quarter ended June 30, 2022.

Second Quarter Highlights

- Record second quarter revenue of $243.2 million in 2022 on 471 acceptances.

- Deployed first fuel cells in the European Union with Ferrari and announced first USA electrolyzer order with LSB Industries.

- Commenced operations in our new Fremont facility which is expected to add a gigawatt of capacity by 2023.

- Reaffirming our 2022 financial outlook.

Commenting on second quarter results, KR Sridhar, founder, chairman, and CEO of Bloom Energy said, “Bloom Energy is continuing to innovate, execute and deliver value in a multitude of energy transformation market segments. In this everchanging energy marketplace and policy environment, the flexibility of our platform is a unique advantage and strength that sets Bloom Energy apart in the energy industry.”

Greg Cameron, executive vice president and CFO of Bloom Energy added, “We had a very strong operating quarter delivering record Q2 revenue, expanding our margins and building the manufacturing capacity to support our growth. We remain confident in our business and are reaffirming our 2022 financial guidance. With our solid record of accomplishments, we believe the company is at an inflection point to build upon our mature technology platform and achieve our robust growth roadmap given.”

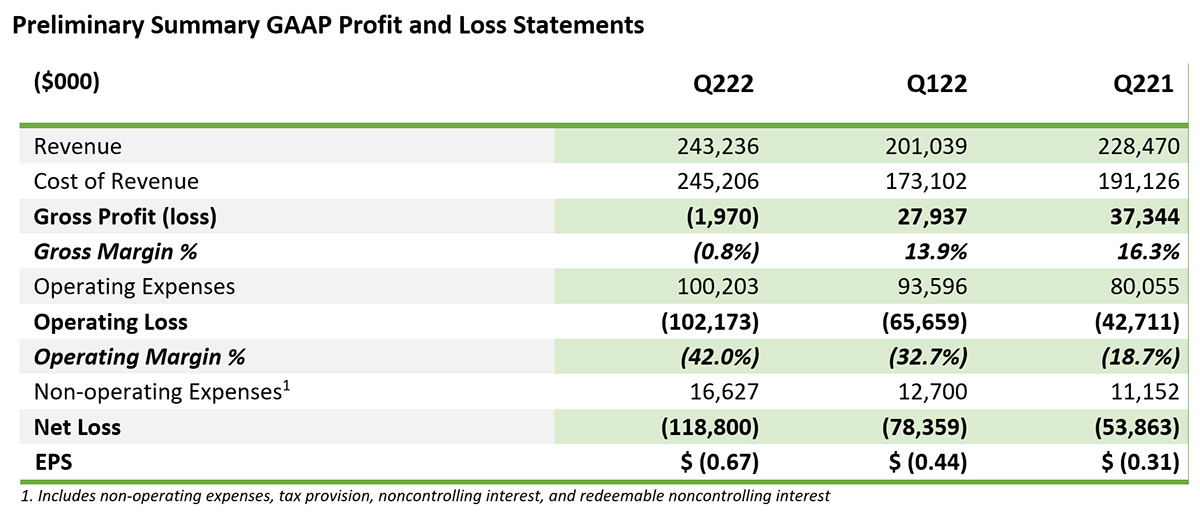

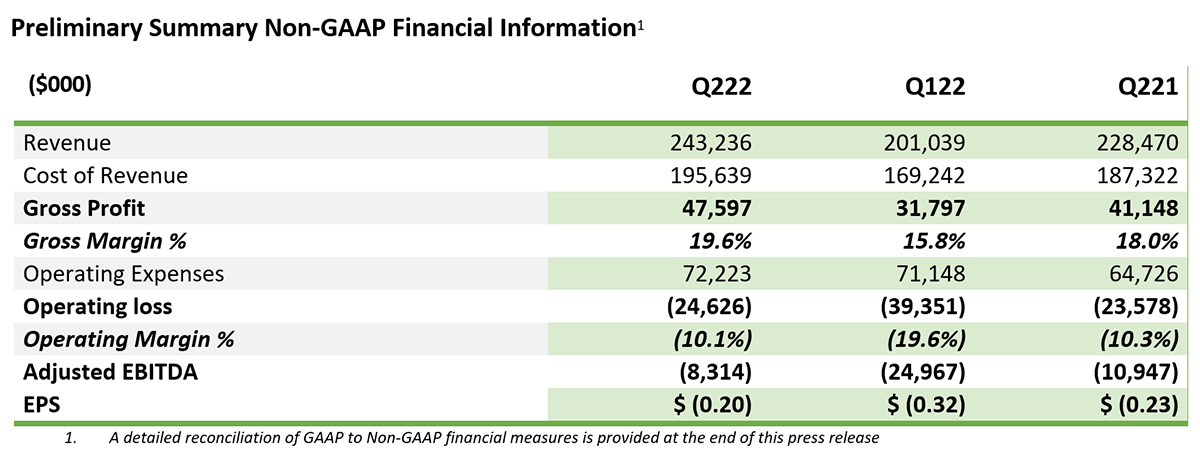

Summary of Key Financial Metrics

Outlook

Bloom reaffirms outlook for the full-year 2022:

- Revenue: $1.1 – $1.15 billion

- Product & Service Revenue: $1 billion

- Non-GAAP Gross Margin: ~24%

- Non-GAAP Operating Margin: ~1%

- Cash Flow from Operations: Positive

Acceptances

We use acceptances as a key operating metric to measure the volume of our completed Energy Server installation activity from period to period. Acceptance typically occurs upon transfer of control to our customers, which depending on the contract terms is when the system is shipped and delivered to our customers, when the system is shipped and delivered and is physically ready for startup and commissioning, or when the system is shipped and delivered and is turned on and producing power.

Conference Call Details

Bloom will host a conference call today, August 9, 2022, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss its financial results. To participate in the live call, analysts and investors may call +1 (844) 200-6205 and enter the passcode: 346737. Those calling from outside the United States may dial +1 (929) 526-1599 and enter the same passcode: 346737. A simultaneous live webcast will also be available under the Investor Relations section on our website at https://investor.bloomenergy.com/. Following the webcast, an archived version will be available on Bloom’s website for one year. A telephonic replay of the conference call will be available for one week following the call, by dialing +1 (866) 813-9403 or + 44 204-525-0658 entering passcode 050636.

Use of Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures as defined by the rules and regulations of the Securities and Exchange Commission (SEC). These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. Bloom urges you to review the reconciliations of its non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in this press release, and not to rely on any single financial measure to evaluate our business. With respect to Bloom’s expectations regarding its 2022 Outlook, Bloom is not able to provide a quantitative reconciliation of non-GAAP gross margin and non-GAAP operating margin measures to the corresponding GAAP measures without unreasonable efforts.

About Bloom Energy

Bloom Energy empowers businesses and communities to responsibly take charge of their energy. The company’s leading solid oxide platform for distributed generation of electricity and hydrogen is changing the future of energy. Fortune 100 companies around the world turn to Bloom Energy as a trusted partner to deliver lower carbon energy today and a net-zero future. For more information, visit www.bloomenergy.com.

Forward-Looking Statements

This press release contains certain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or the negative of these words or similar terms or expressions that concern Bloom’s expectations, strategy, priorities, plans or intentions. These forward-looking statements include, but are not limited to, Bloom’s expectations regarding revenue growth, margin expansion and its innovative solutions; Bloom’s expectations regarding its growth plans, including those regarding output from the Fremont facility, and Bloom’s financial outlook for 2022. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors including, but not limited to, Bloom’s limited operating history; the emerging nature of the distributed generation market and rapidly evolving market trends; the significant losses Bloom has incurred in the past; the significant upfront costs of Bloom’s Energy Servers and Bloom’s ability to secure financing for its products; Bloom’s ability to drive cost reductions and to successfully mitigate against potential price increases; Bloom’s ability to service its existing debt obligations; Bloom’s ability to be successful in new markets; the ability of the Bloom Energy Server to operate on the fuel source a customer will want; the success of the strategic partnership with SK ecoplant in the United States and international markets; timing and development of an ecosystem for the hydrogen market, including in the South Korean market; continued incentives in the South Korean market; the timing and pace of adoption of hydrogen for stationary power; the risk of manufacturing defects; the accuracy of Bloom’s estimates regarding the useful life of its Energy Servers; delays in the development and introduction of new products or updates to existing products; Bloom’s ability to secure partners in order to commercialize its electrolyzer and carbon capture products; the impact of the COVID-19 pandemic on the global economy and its potential impact on Bloom’s business; the availability of rebates, tax credits and other tax benefits; changes in the regulatory landscape; Bloom’s reliance on tax equity financing arrangements; Bloom’s reliance upon a limited number of customers; Bloom’s lengthy sales and installation cycle, construction, utility interconnection and other delays and cost overruns related to the installation of its Energy Servers; business and economic conditions and growth trends in commercial and industrial energy markets; global macroeconomic conditions, including rising interest rates, recession fears and inflationary pressures, or geopolitical events or conflicts; overall electricity generation market; Bloom’s ability to protect its intellectual property; and other risks and uncertainties detailed in Bloom’s SEC filings from time to time. More information on potential factors that may impact Bloom’s business are set forth in Bloom’s periodic reports filed with the SEC, including our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 as filed with the SEC on May 6, 2022, as well as subsequent reports filed with or furnished to the SEC from time to time. These reports are available on Bloom’s website at www.bloomenergy.com and the SEC’s website at www.sec.gov. Bloom assumes no obligation to, and does not currently intend to, update any such forward-looking statements.

The Investor Relations section of Bloom’s website at investor.bloomenergy.com contains a significant amount of information about Bloom Energy, including financial and other information for investors. Bloom encourages investors to visit this website from time to time, as information is updated and new information is posted.

Investor Relations:

Ed Vallejo

Bloom Energy

+1 (267) 370-9717

Edward.vallejo@bloomenergy.com

Media:

Bloom Energy